Mumbai tax tribunal held that the difference between the transfer value and the cost of acquisition shall be...

Read MoreBlogs

Articles

Latest Blogs

Stay informed with expert-written articles on tax case laws, government notifications and GST essentials.

Amendments in Tax Audit reporting in Form 3CD

List of key amendments made by CBDT in Form No. 3CD notified vide Notification No. 23/2025 which had...

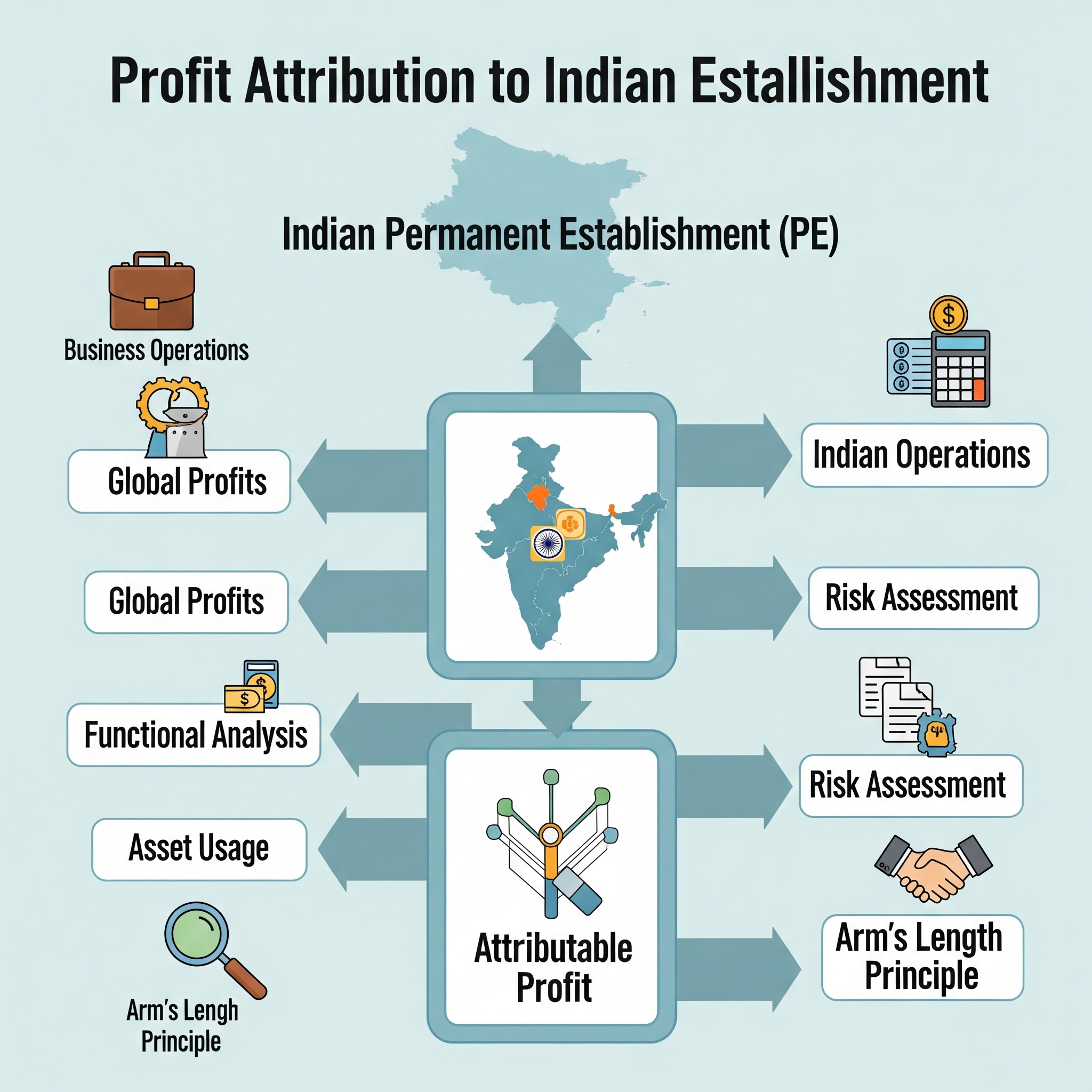

Read MoreProfits arising from offshore supply of equipment shall NOT be attributable to PE under ‘force of attraction rule’

Indian Tax Tribunal (‘ITAT’) has held that profits on off-shore sale of equipment shall not be attributable to...

Read MoreFrench Apex Court’s ruling on tax treaty benefits on dividend payments

French Apex Court held that tax treaty benefits for lower withholding tax rates on dividends is available only...

Read MoreDelhi High Court Directs CBDT to Apply VsV Scheme, 2024 to Taxpayers with Pending Appeal Deadlines

The Delhi High Court (‘HC’) has directed Central Board of Direct Taxes (‘CBDT’)/ Indian tax department to consider...

Read MoreSwiss Government suspends application of the most favoured nation clause of the protocol to India – Swiss DTAA

Switzerland has issued a statement suspending application of the Most Favoured Nation (‘MFN’) clause of the Protocol to...

Read MoreTribunal ruling on TDS liability / Form 26A cases

Mumbai tax tribunal held that liability to deduct TDS does not arise on a person for payments which...

Read MoreSummary of important GST amendments in last couple of months

Summary of important GST updates published via the advisories in the GSTN portal are provided below: Introduction of...

Read MoreProfit attribution to Indian PE

Indian High Court (‘HC’ or ‘the Court’) ruling wherein it was held that the global profits or losses...

Read More