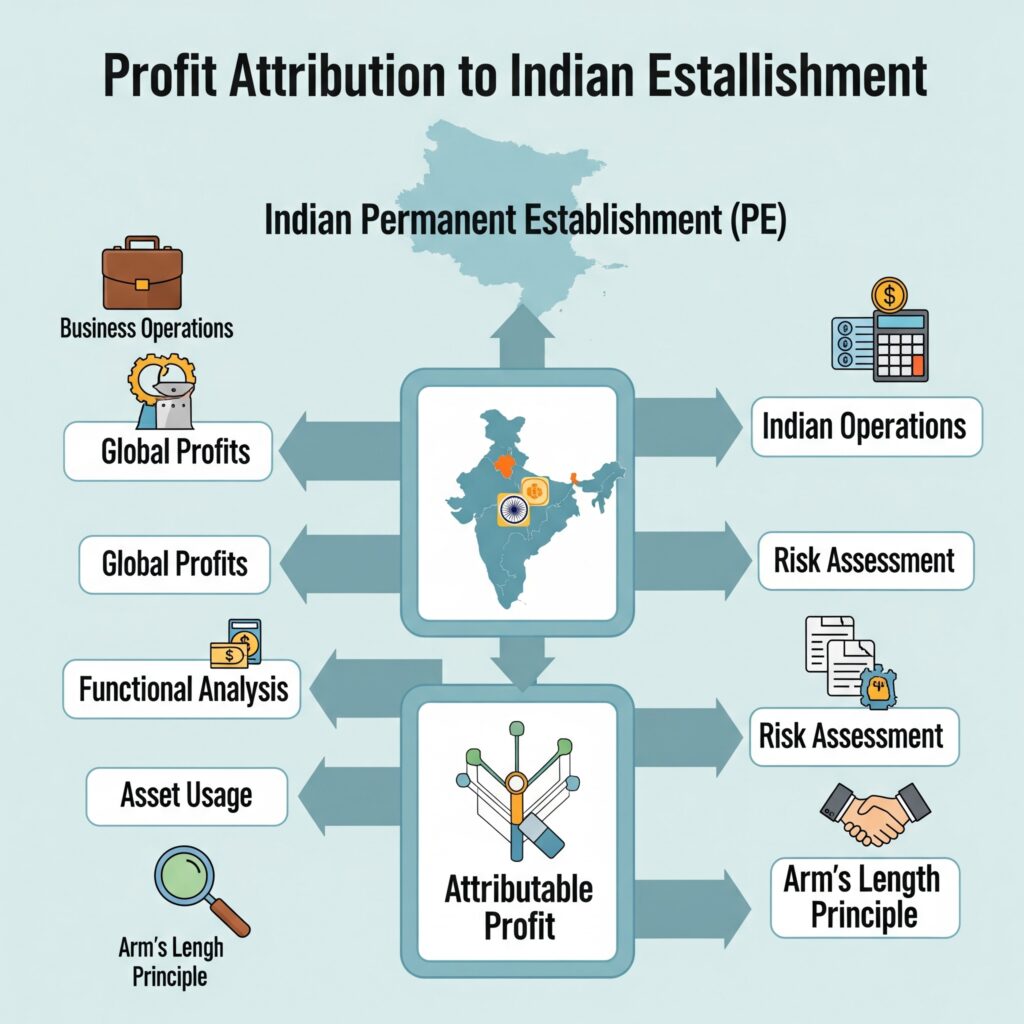

Profit attribution to Indian PE

Indian High Court (‘HC’ or ‘the Court’) ruling wherein it was held that the global profits or losses of an enterprise is an irrelevant factor for the purpose of profit attribution to an Indian Permanent Establishment (‘PE’).

Facts of the case

- Hyatt International Southwest Asia Ltd. (‘Hyatt’ or ‘taxpayer’) is an entity based in the United Arab Emirates (UAE) that provides strategy oversight and management services to its subsidiaries and affiliates through agreements.

- The Indian revenue authority stated that the service charges earned by the taxpayer through said agreements are liable to be taxed as ‘royalty’ under Income Tax Act, 1961 (‘ITL’) and the India-UAE Tax Treaty.

- The taxpayer appealed before HC wherein it stated that no profit can be attributed to a Permanent Establishment (‘PE’) if a MNE is making global losses, referring to a favourable jurisprudence in CIT vs. M/s. Nokia Solutions and Networks OY. A Full Bench of HC (‘the Full Bench HC’) was constituted to assess the correctness of decisions made in the said case.

Key excerpts from the ruling

- The Full Bench HC held that a PE must be viewed as a separate and distinct center for the purposes of fiscal treatment and taxation.

- The Full Bench, referring to Article 7 of UN Model Convention, warranted that a PE must be taxed independently irrespective of the fact that such PE is part of a larger Multinational Enterprise (‘MNE’).

- The Full Bench further held that upon perusal, Article 7 constructs a dichotomy between profits earned by an entity on a global scale and the same which are attributable to a PE in clear and unambiguous terms. Article 7 can be construed to mean that profits attributable to a PE constitutes as a separate source of profit since the taxation right of a source state is dependent upon the existence of a PE.

- The Full Bench also referred to Section 5 of ITL wherein the precept of taxation based on source is mirrored. The said section confines global income to be taxed only in case of residents for Indian tax purposes.

- Therefore, the Full Bench ruled in favour of the revenue authority and held that a PE must be taxed as a distinct entity independent of the operations and financial results of MNE it forms part of. The Full Bench thereby overturned the erstwhile favourable jurisprudence as per CIT vs. M/s. Nokia Solutions and Networks OY.

This ruling sets a precedent that is likely to resonate across jurisdictions, influencing the interpretation of Article 7 in similar contexts. As the debate around the taxation of MNEs continues to evolve, this decision serves as a reminder of the importance of respecting the economic nexus between a PE’s local activities and the tax obligations within the source State. The ruling not only fortifies the principle of income attribution but also reinforces the autonomy of source States in safeguarding their tax bases. This ruling also carries a lot of weightage for genuine cases where MNE’s incur losses at a global level owing to entry strategy/ business & commercial reasons.