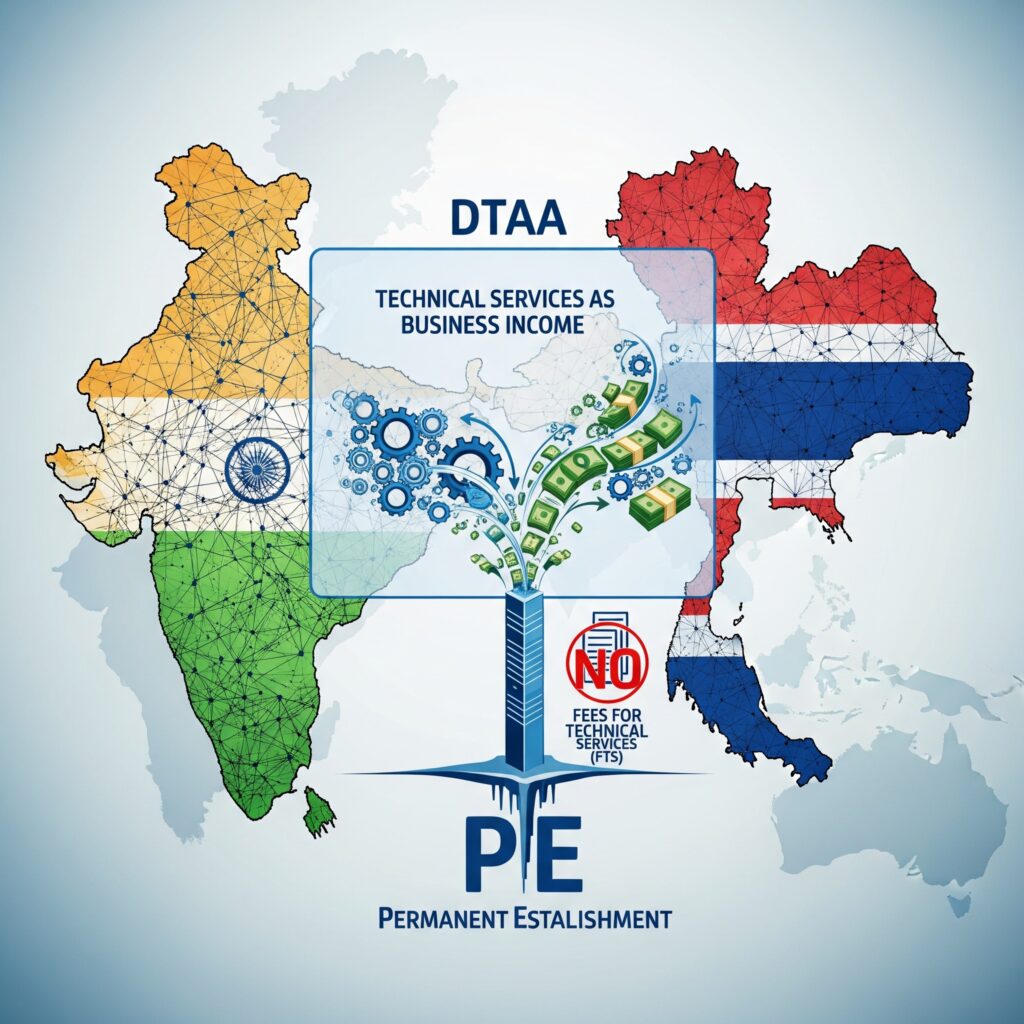

Absence of FTS in India-Thai DTAA, technical services to AE constitutes business income, not taxable sans PE

Indian tax tribunal ruling wherein it was held in absence of Fees for Technical Service (‘FTS’) clause under a tax treaty (‘DTAA’), any technical services provided to Affiliated Entity (‘AE’) amounts to business income and the same is not taxable provided, it does not have any Permanent Establishment (‘PE’) in India.

Brief Background

- The taxpayer is a Non-Resident entity (based out of Thailand) and received income for providing services to an Indian resident entity which is an affiliated entity of the non-resident entity.

- The issue was whether the income received by the non-resident entity is taxable as Fees for Technical Services or business income under the purview of Indian Income Tax Act, 1961 (‘ITL’).

Key excerpts from the ruling

- The DTAA between Thailand & India does not have a clause on taxability of provision for Fees for Technical Services but contains a clause relating to taxability of services provided which are in the nature of business activities covered in ‘Article 7 of DTAA’.

- However, the business income cannot be taxed in India if the taxpayer does not have a PE in India. Moreover in the absence of any clause relating to an income/activity, then the subject income shall be assessable as business income.

- The tax tribunal held that, the tax officer erred in drawing an inference on examining the business activity of the Assessee which is mandatory for determining the nature of income for the purpose of taxability. The subject income is actually an income from taxpayer’s business activity which is not taxable in India in absence of PE.

- It is important to note that the tribunal also rejected taxpayer’s invocation of residuary Article 22 of DTAA (relating to ‘Other Income’) to tax the remittances in absence of FTS clause;

- Thus, the income earned by the Non-resident taxpayer cannot be considered as FTS but shall be considered as Business Income arising for its normal business activities.

This ruling will be relevant to determine taxability of service payments to non-resident entities that do not have PE in India and wherein the applicable tax treaty does not have a specific FTS article therein. The following are the countries which do not have a separate FTS article in the DTAA between India – Bangladesh, Brazil, Greece, Libya, Nepal, Philippines, Syria, Thailand, UAE. Moreover, it would be beneficial for non-resident entities to explore this favourable interpretation in the absence of PE in India.